Submitted by: Jaynie L. Smith, CEO, Smart Advantage, Inc.

You Have the Wrong Number! Your Differentiation Strategy is at Risk

It sometimes seems that many businesses have more measurements, controls, and processes than NASA. Others have virtually none.

In my 30 years’ experience working very closely with hundreds of companies of all sizes, I have seen only a handful with metrics that are aligned with the highest buying criteria of their customers and prospects.

Strategic differentiation depends on having the right numbers.

KPIs are not Enough

What most organizations focus on are common KPIs (Key Performance Indicators) which often look like this list:

- sales per employee

- cash flow

- dollars per rep

- employee turnover

- gross profit per day

- labor costs to sales

- new orders booked

- training as a % of sales

- accounts receivables, etc.

We recently reviewed a list of 100 KPIs published in a business book. Only 5 of them had any impact on the customer.

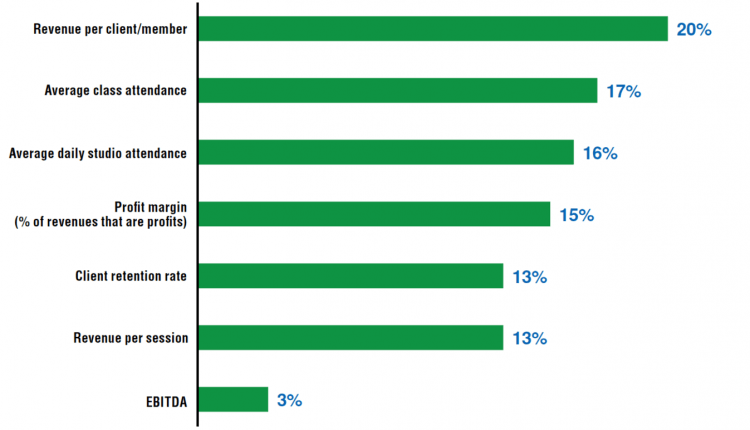

Here is a classic example I found online for the fitness industry from *Source: Association of Fitness Studios 2016 Operations & Financial Benchmarking Research Report

We’ve selected the top 5 based on the Association of Fitness Studios (AFS) research, which is a valuable resource to gain a full understanding of the flow of your business.

The graph shown below, from the Association of Fitness Studios 2016 Operating & Financial Benchmarking Report details the KPIs of primary focus for fitness studios of all sizes and disciplines

Are these important to a fitness club owner? You bet. But every industry has a list of the top five to ten KPI’s, and rarely do they have anything to do with a winning differentiation strategy, or with what the customer values.

Scan books and articles on customer metrics and you will find things such as pricing and packaging, positioning and presence, customer profitability, customer lifetime value, customer loyalty, conversion rate, churn rate, net promoter score, and the list goes on.

Then there are the brand metrics: brand awareness, brand perceptions, brand engagement, etc.

A Focused Differentiation Strategy

Differentiation depends on the right metrics

All of these are incredibly necessary internal metrics, however, none of these matter to the customer — This is all great information for the company to have as its control panel, but these metrics have extraordinarily little that matters to customers. You’re not likely to choose one company over another based on their churn rate.

The performance most measured by companies is that which benefits them, grows them, and produces better margins. That is a must. But what has been neglected are the metrics, the evidence, that benefit the customers: on time, in full, quality, responsiveness, accuracy, etc.

Strategic differentiation is not just about new products or services but about doing what is valued much better than the other guy.

You may be half way there already

On a slightly more positive note, many companies have some good customer focused metrics, but rarely – or never – use them consistently and clearly in their marketing and sales messaging.

When I ask if they do, I am commonly told “oh sure, we measure on-time delivery.” I reply, “okay great but…

- Do all your salespeople know the measurement, is it updated monthly, quarterly?”

- Are you sure they are touting it in sales presentations?”

- Are they sharing the metric to remove risk in the buying decision?”

The most common response is a meek, “no.” This is a gigantic missed opportunity. If you want strategic differentiation right away, start here.

Arm your salespeople with the impressive performance metrics you may already have today. We find scores of them in companies that are not being used. Once we dig them out, validate them, and wordsmith them, sales people are now weaponized to go after the competition.

Broad Differentiation Strategy

Broad differentiation strategy for many companies often relies on strengths. They have done the trusty old SWOT analysis and listed their strengths and weaknesses.

Then they cheerfully accept their strengths as differentiators. The list they have cheered is usually a list of givens: good customer service, expertise, quality, reputation, flexible, etc.

When asked if their competitors tout those things, most will confess, “yes, of course.” Hence, they are not the seeds for a strategy of good differentiation, simply put.

Differentiation Strategy Examples

We have worked with several companies whose most important attribute was first-call resolution. Only about a third of the companies had such a metric, and for those that did, none communicated their performance results to their customers.

They viewed it simply as an internal report card on their efficiency, not realizing that their customers might also value it. Once they provided sales teams with this evidence and required them to make this part of their messaging, sales close rates skyrocketed.

Every Company has Hidden Differentiators they don’t know about!

Another client measured quality based on its product return rate, but they never analyzed it.

When we reviewed eight years of their product return data, we learned that their return rate was less than one percent for all eight years. None of their competitors could say that.

They clearly had a differentiation claim they were not using. They conducted a double blind customer research study and it revealed quality was the number one attribute required in the buying decision.

They immediately armed the salespeople with the impressive data, and not surprisingly, close rates shot up.

A double blind customer research study is the first step in finding out the top buying criteria for your customers. Double blind removes bias and allows the responding customer or prospect to “tell the truth”.

Lower Price is not a good Differentiation Strategy

You might be surprised to see how infrequently price ranks at the top of the list when testing attributes in a double-blind study. Yet “Price is the issue” is the battle cry declared over and over by salespeople who try to convince management to lower the price to make the sale.

To be fair, they hear it all day every day. That is because negotiation is underway. If the salesperson has no differentiation, then they have painted themselves into a commodity corner and it is, in fact, all about price.

If you repeatedly cave in on price you are not just “winning” that sale, you are destroying your margins. Not a good strategy, ever.

But if you can validate with good metrics that you have better quality, more accuracy in shipment, better on-time performance, etc., you are building operational strategic differentiation.

95% of businesses don’t know their customers’ top buying criteria

Over the last 20 years, Smart Advantage has conducted over 300 double blind studies for many companies in varied industries. When we delivered the findings to the company executive team, we learned:

- 95% of companies did not know their customers top buying criteria

- 85% did not measure that which is most valued

To top it off, less than 5% of SMBs (small, midsized business) invested in any serious customer research. Large companies spend money on the research, but it often leads to little or no operational execution.

Keep in mind strategic differentiation establishes competitive advantages. Here is a case study right out of my best-selling book, Creating Competitive Advantage (Doubleday, Random House) :

” One client of mine, the CEO of an interior design firm, was having problems with closing deals. His 22 interior designers were delivering customers, but the CEO had to close every deal himself.

He was almost burned out because he had to spend so much time on closings. He asked me to help convert his designers into salespeople. He wanted them to close the deals themselves.

I give a lot of credit to the CEO/owner for recognizing that he should not have been spending so much of his time on matters that his staff should have handled.

Too many CEOs spend too much time in their businesses instead of on their businesses.

The CEOs’ job is to be the captain up on the bridge, directing the ship, keeping an eye on the horizon for new targets, and steering clear of the icebergs. He shouldn’t be stoking coal in the boiler room, or tending lines.

Jim Collins drives this point home in his best seller, Good to Great. He calls the best top executives as Level 5 leaders. “Level 5 leaders channel their ego needs away from themselves and into the larger goal of building a great company,” he writes. “It’s not that Level 5 leaders have no ego or self-interest. Indeed, they are incredibly ambitious–but their ambition is first and foremost for the institution, not themselves.”

It shouldn’t be surprising that Bill Gates has insisted upon taking a week off each year to sit in a lakeside cabin to think about the company/organization’s future and read and evaluate employee ideas and proposals.

His annual retreat stirs his imagination and gives him a chance to look at the bigger picture. If he doesn’t do it, who will?

For my designer client to be able to spend more time on his business, he had to turn his designers into closers. But they were non-traditional sales types and would require a lot of sales training.

There are plenty of sales schools that the CEO could have turned to, but they can be expensive and time-consuming and would keep his designers off the showroom floor too long.

We decided that the best solution was to arm the designers with one sales tool they were sure to use–the company’s competitive advantages.

When it came time to close deals, the designers would point out those advantages to their clients, and the deals would go down without the presence of the CEO.

Strategy Workshop

We scheduled a Saturday workshop session at a conference center near his company’ offices and then alerted his staff to set the date aside for the all-day encounter.

At the workshop session, the CEO and his design team spouted lots of reasons why customers should use his company. The principal reasons they cited were that it employed talented designers; could offer one-stop shopping; guaranteed its work; had a strong infrastructure; had strong teams; and generally provided good service.

Yeah, but what did all those qualities really mean to customers? Every design firm was selling the same theme to the same prospects. What was so special about this one?

The firm certainly had a lot of brag about–from industry awards to high profile, repeat commercial clients. It also had an impressive list of individual homeowners who were very satisfied and repeat customers.

Those clients knew the quality and reliability of the firm’s work. They trusted the firm to meet deadlines and they were not disappointed.

So the task became quantifying these special qualities, so they wouldn’t sound like empty generalities. After drilling down a lot deeper during the workshop, the designers came up with competitive advantages that were a lot more specific and a lot more meaningful and persuasive to customers.

Key among them was the fact that the company stays on budget 95% of the time. This is critical to clients, especially commercial clients. For developers, the firm also offered these Competitive Advantages:

- The only design team chosen by the top 10 luxury developers in the state

- Real-estate developers’ sales ratios rose by 35% after using the firm

- A computer-assisted design saves up to 10 days in project scheduling and allows for same-day changes.

- The only firm providing daily job supervision with onsite project managers.

For homeowners, the firm offered these competitive advantages to consider:

- Ninety-eight percent of our designers who entered design competitions won awards–a total of 59 in the past ten years.

- The firm’s debt-free stability assures that vendors and contractors show up on time. (They know they will be paid on time, so they show up on time).

- The firm’s designers have an average of 23 years design experience, and are available 24 hours a day, six days a week.

- Ninety percent of residential clients come from referrals or are repeat customers.

Since identifying and touting these Competitive Advantages to clients, the CEO reports that his closing rate has climbed 30%. Not only were the designers able to close deals, they were closing more of them than the CEO could manage himself. And they were doing it without the trouble or expense of any sales training.

When you consider that there was no additional cost for getting this new business–other than identifying and broadcasting his competitive advantages–the bottom-line results were eye-popping.”

Strategic differentiation can be found in what you already do, what you already have as long as you line it up with top buying criteria of your customers; and, you must excel operationally in those top valued customer deliverables. The good news is you do not need to strategically master 20 operational metrics. Differentiation can be had by superior performance in two to three top buying criteria.

Is Free Shipping a differentiation strategy that can last?

Walmart, Amazon and the others

Amazon clearly paved the way for online shopping. Covid taught millions more how to shop on line.

Walmart began competing in this space and is gradually making headway little by little to compete with Amazon. Shoppers have an expectation around “free delivery”.

For Amazon, you had to join Prime to get it, although often we forget we paid a fee for it and think Amazon has a real differentiation. Grocery chains like Publix and Kroger are in the space now.

Others, like Target, are going to have to play the digital game well and fast to stay relevant also. When shipping for free is an expectation for all of them, then it is no longer a differentiation strategy.

So what will they need to come up with next? The billion-dollar question. For Amazon right now, it is their extraordinary shipping and hubs. With airlines looking for revenue, perhaps they might prop up some of the others. Just a wild guess.

Summary

Before I conclude this article, I want to share another excerpt from Creating Competitive Advantage:

Even the best salespeople can’t close many rotten deals.

There are only so many suckers out there. It takes a truly gifted salesperson to sell unseen swampland in Florida. On the other hand, it doesn’t take a superstar to close a deal that the customer wants.

All it takes is a script of your competitive advantages. After all, remember your competitive advantages answer the customer’s most crucial question: Why should I buy from you? If you persuasively answer that question, your deal is closed.

And who is asked that question most often? Your sales force. They are your front line, and they should be able to answer that question, in spades. But too often they don’t know, or haven’t been told, or don’t pay enough attention to your competitive advantage.

My work with companies has confirmed that most salespeople are using the old clichés to tout their companies’ advantages. If I ask ten salespeople in one company “why us,” I often get ten different answers.

To top that off, the CEO often has his own version, not shared with his own sales force. And none of them answer the question “why us?”

The goal is to have competitive advantages derived from operational excellence that can be validated with solid metrics for the top three to four top customer buying criteria.

The salesforce must know them and consistently deliver them. Marketing needs to share the same information. Management needs to put into the hands of salespeople updated metrics monthly, or at a minimum, quarterly. Voila, strategic differentiation.

Strategic Differentiation Must be based on The Right Numbers that are Relevant to the Customer

FAQs:

What is the best way to learn what my customers truly value in the buying decision?

At Smart Advantage, we firmly believe that double blind research which surveys both your customers and prospects to rank their hierarchy of buying criteria is a good first step. Double blind is necessary to remove bias and get projectable data. We recommend going for a minimum 90% confidence level with a plus/minus 10% error rate

What are the advantages of differentiation?

Differentiation builds competitive advantage; and that removes you from commodity status in sales encounters. If customers continue to ask for a lower price, then they have not seen a solid competitive advantage