I recently bought a new car. It can be a considerable investment. Most of us will do a fair amount of research on the vehicle of choice from options to pricing. It’s a good practice to be adequately armed. Yet in business many companies make significantly larger investments setting up new profit centers or buying companies, with little or no research. They take the plunge and hope for the best. That’s called gambling.

Between 70% and 80% of mergers and acquisitions fail to produce the hoped-for outcomes.

The pandemic and supply chain issues have resulted in many companies pursuing more growth opportunities; new products, expanded services, new market segments. Some pursuits are accomplished internally; others by buying companies who have already carved out the market.

Here are a few examples of maximizing success:

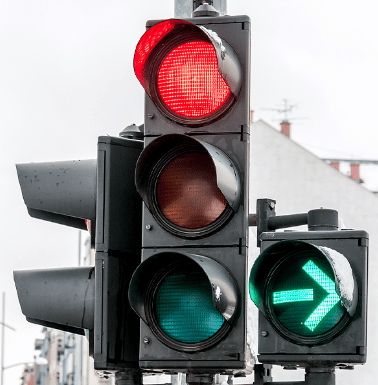

New Geography A client of ours wanted to open in a new geographic market entrenched by his competitor, but he wanted to go after a particular niche their competitor did not serve well. With a bit of research, the company learned they had a bright green light. Their research uncovered a few little-known requirements on how best to approach the region, thus maximizing their chances of success

Go Direct or Not One company wanted to learn if they should go direct to retailers cutting out their wholesalers. This was a frightening prospect. Losing their wholesalers could have done them in completely. Much to their surprise with a small investment in double blind research, they learned direct sales was more than welcome by most of the retailers who used their products. Not just to cut out the middleman but it would allow for better communication. And the wholesalers were happy that retailers could get items directly that the wholesalers didn’t carry – and didn’t want to. The client proceeded and business grew quickly.

On the other hand, one manufacturing client learned from research that bypassing the distributors would be a death knell because the distributor staff had the technical expertise and ready accessibility customers wanted.

New Add on Business One CEO was looking to expand in a new but complementary industry by acquiring a company. It was an enhanced service they do not offer but saw it as an add on to their palette of existing services. They had a lot of perceptions, or rather “guesses” of how the new industry worked. They wanted to know if the market was viable for them. Before making a sizeable investment, they commissioned research to learn if and how it was a fit with what they sold, and more importantly, what the new target market valued when choosing a supplier. Guesses were replaced with solid information giving them a big go ahead, but with some specific direction on how best to serve, and market to, new customers.

Seems like common sense but you might be surprised how often costly mistakes are made by guessing and gambling. Improve your odds of success next time you are evaluating new revenue streams. A little research helps you “look both ways” before crossing into unknown territory. You likely won’t buy that car without research; why dive into a new company or product line without it?